The Real Odds You’re Up Against

It’s not the losses that get you. It’s the leaks. And most people don’t even know where their money’s going.

Untracked Spending

You think you’re in control, but you’re betting blind. If you’re not tracking your dollars, they’re disappearing faster than your wins.

Chasing Losses

That feeling when you’re down and think another bet will get you back? It’s a trap.

Financial Stress

The longer you ignore it, the heavier it gets. Manage your money, manage your peace.

Impulsiveness

you've got the urge, but where's the strategy. Emotions and betting don't go together.

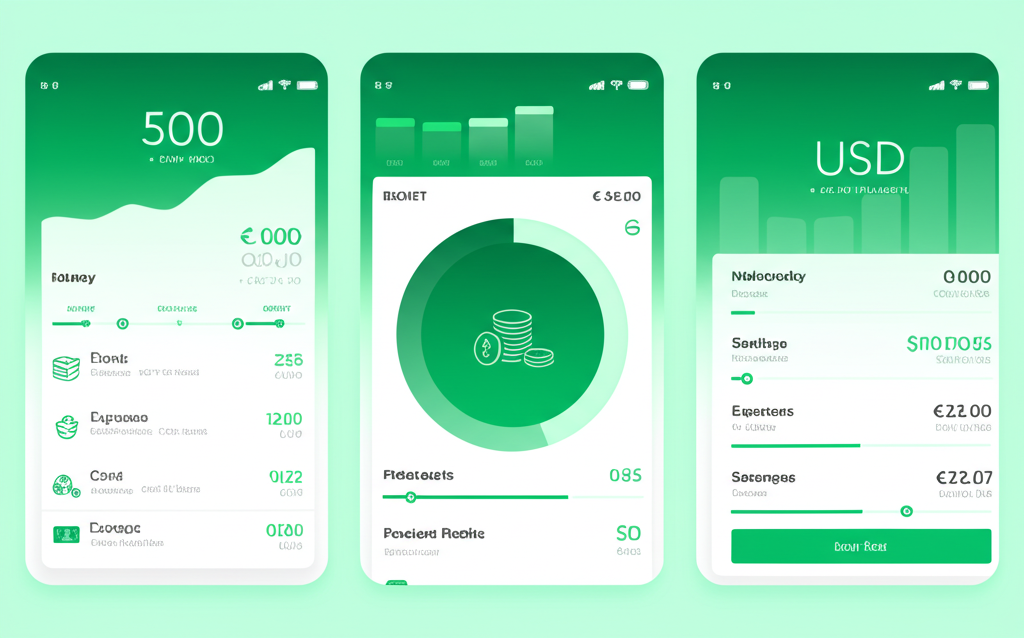

Introducing Bet+ER

A dedicated buffer account and app built for sports bettors who want to stop gambling with their money and start controlling it.

- Separate your betting funds from essential expenses

- Track your betting habits with detailed analytics

- Get alerts when you're approaching your limits

- Use the dedicated Bet+ER card for all betting transactions

How It Works

Get started in four simple steps and take control of your betting finances.

Link Your Bank Securely

Connect your existing bank account with bank-level encryption and security.

Get Your AI Budget

Our AI analyzes your finances and suggests a responsible betting budget.

Fund Your Bet+ER Account

Transfer your dedicated betting funds to your separate Bet+ER account.

Spend Responsibly

Use your Bet+ER card for all betting transactions with real-time tracking.

Key Features

Designed specifically for sports bettors who want better financial control.

AI-Powered Budgeting

Smart algorithms analyze your financial patterns to suggest a responsible betting budget that won't impact your essential expenses.

Dedicated Bet+ER Card

A separate physical and virtual card exclusively for your betting activities, keeping your finances organized and transparent.

Real-Time Alerts

Get instant notifications when you're approaching your betting limits or when unusual spending patterns are detected.

Own your Game. Own Your Life

At Bet+ER, we exist to help people reclaim control in a world built for impulse. As digital habits blur the line between entertainment and escape, we give users the tools to pause, plan, and make choices that align with their real lives.

Our mission? Turn the chaos of convenience into clarity. We guide you toward smarter choices, stronger habits, and a life that’s intentional, no matter how fast the world moves.

Financial Protection

Creating a buffer between impulse and action

Habit Formation

Building sustainable financial behaviors

Mindful Spending

Promoting awareness in financial decisions